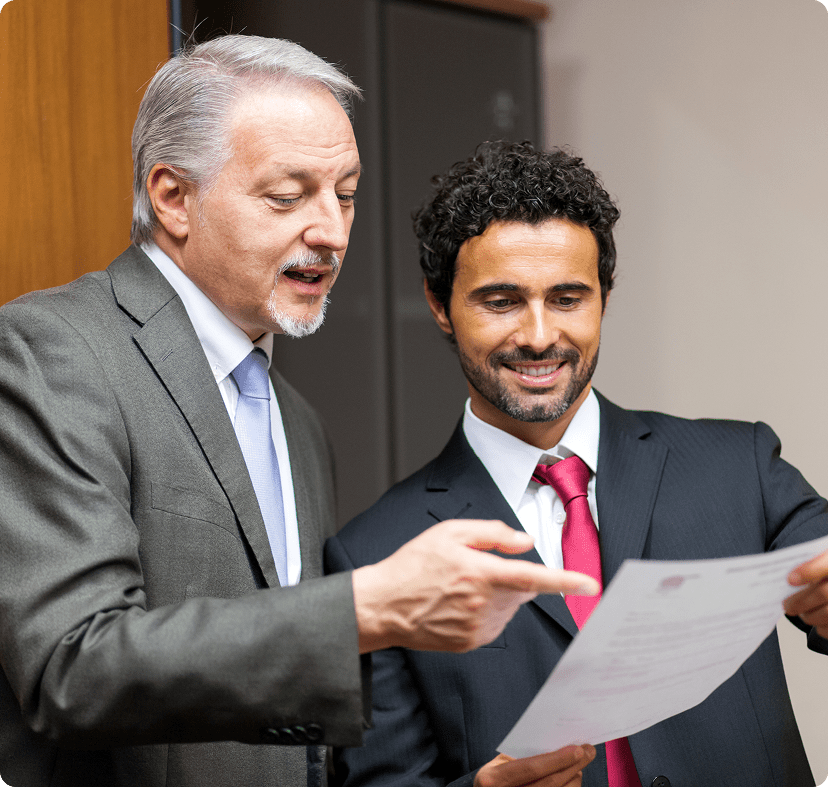

Thinking About Selling Your Business?

Work with an M&A advisor focused entirely on protecting value, confidentiality, and outcomes for business owners. Selling a business is not something you rush into or hand over lightly. It’s a major decision, often tied to years of effort, risk, and personal sacrifice.

Churchill Mergers supports business owners through a controlled, confidential sale process designed to achieve the best possible result without pressure, exposure, or shortcuts.

Poorly run processes lead to:

- Low offers

- Delays

- Lost leverage

- Deals falling apart late

- Confidentiality risks

What a structured sale avoids:

- Being tied to a single buyer

- Disruption to staff or clients

- Long, draining negotiations

- Last-minute retrades

- Undervaluation due to weak positioning

The Way You Sell Matters as Much as Who Buys

Many owners assume selling a business is about finding ‘the right buyer.’ In reality, the outcome depends far more on how the sale is handled. As business sale advisors, our role is to manage the entire process properly not just introduce buyers.

We start by understanding

- Why you’re considering a sale

- Whether it’s full or partial

- Whether it’s full or partial Your timing expectations

- Your involvement post-sale

- What a “successful exit” looks like for you

Our seller-focused approach includes

- Clear exit planning before going to market

- Controlled buyer engagement

- Defined timelines and milestones

- Support through every decision point

- No pressure to accept the wrong deal

You Stay in Control at Every Stage

Every sale we run is seller-led. That means the process works around your priorities, not the buyer’s timetable.

From there, we build a clear business exit strategy that supports value and protects your position throughout.

One Offer Is a Risk. Multiple Offers Create Strength.

Accepting the first offer rarely leads to the best result. Real leverage comes from buyer competition. Churchill Mergers creates interest from multiple qualified buyers, allowing you to compare offers on your terms.

How we build buyer interest:

Confidentiality Is Not an Add-On, It’s the Foundation

For most owners, the biggest concern is exposure. Staff, clients, suppliers, and competitors must not know a sale is underway until the time is right. We specialise in confidential business sales.

Understand What Buyers Will Pay And Why

Many owners receive conflicting opinions on value. Some are overly optimistic. Others are unnecessarily conservative. Our role is to give you a realistic, defensible view of value based on

Current buyer demand | Sector activity | Deal structures buyers are accepting | Comparable completed sales

Initial value

range

discussion

Buyer-specific

pricing

expectations

Deal

structure considerations

Negotiation

support to

protect value

Managing price

vs certainty

trade-offs

Staying Close Until Completion

Many deals fail late due to poor coordination, slow responses, or unclear communication. We stay actively involved to keep momentum and manage issues before they escalate.

Our deal execution support includes:

- Managing buyer Q&A

- Supporting due diligence

- Coordinating advisors

- Guiding negotiation on key terms

- Keeping the process moving forward

Trusted by thousands of happy customers are using Churchill Mergers.

Professional Services Firm (UK)

Owner-Managed Business

UK & Europe

Professional Firm

Multi-Jurisdiction Business

Latest trends and business news

Digital, AI & Legal/FinTech: Where the Mid-Market is Going

The convergence of digital transformation, artificial intelligence (AI), LegalTech and FinTech is reshaping the mid-market at an unprecedented pace. What was once the domain of

How Regulatory Uncertainty Is Shaping Deal Structures in 2026

In today’s market, regulatory uncertainty is no longer a background risk in mergers and acquisitions. It is a central factor shaping how transactions are negotiated,

Cross-Border M&A: Inward Investment into the UK Post-Brexit

Cross-Border M&A: Inward Investment into the UK Post-Brexit The UK has long been a global hub for cross-border mergers and acquisitions (M&A), attracting significant international

The Impact of Energy Transition & ESG Investing on UK Deal Flow

The evolving landscape of energy transition and Environmental, Social, and Governance (ESG) investing is reshaping the M&A (Mergers & Acquisitions) deal flow in the UK.

Specialty Finance & Marketplace Lending: M&A Trends and Risks in the UK & Europe

Introduction The landscape of specialty finance and marketplace lending in the UK and Europe is undergoing significant transformation. As of October 2025, the sector is

Preparing for Buyer Due Diligence When Selling Your Business

Maximum Valuation: Preparing for Buyer Due Diligence Maximum valuation is every business owner’s goal when selling. One of the most critical stages to achieve this

Benefits of Negotiating the Sale of a Business Through a Broker

Benefits of Negotiating the Sale of a Business Through a Broker Maximum valuation is the ultimate goal when selling a business, but achieving it is

Maximising Earn-Outs on Selling a Business

Selling a Business: Maximising Earn-Outs Selling a business is one of the most significant milestones for any entrepreneur. While upfront consideration is important, many deals

Get in Touch

Speak to our expert today

Schedule a 15-minute introductory call with a senior partner. It is strictly confidential, free of obligation, and the most important 15 minutes you can spend planning your exit.

- Your inquiry is 100% confidential and secured with 256-bit encryption.

Selling Your Business Starts with a Conversation

Whether you’re months away from a sale or simply testing the waters, the right advice early can make a significant difference. A confidential discussion with Churchill Mergers gives you clarity not pressure.

USA

USA

UK

UK

UAE

UAE

Request a Call

Leave your details and our team will contact you.