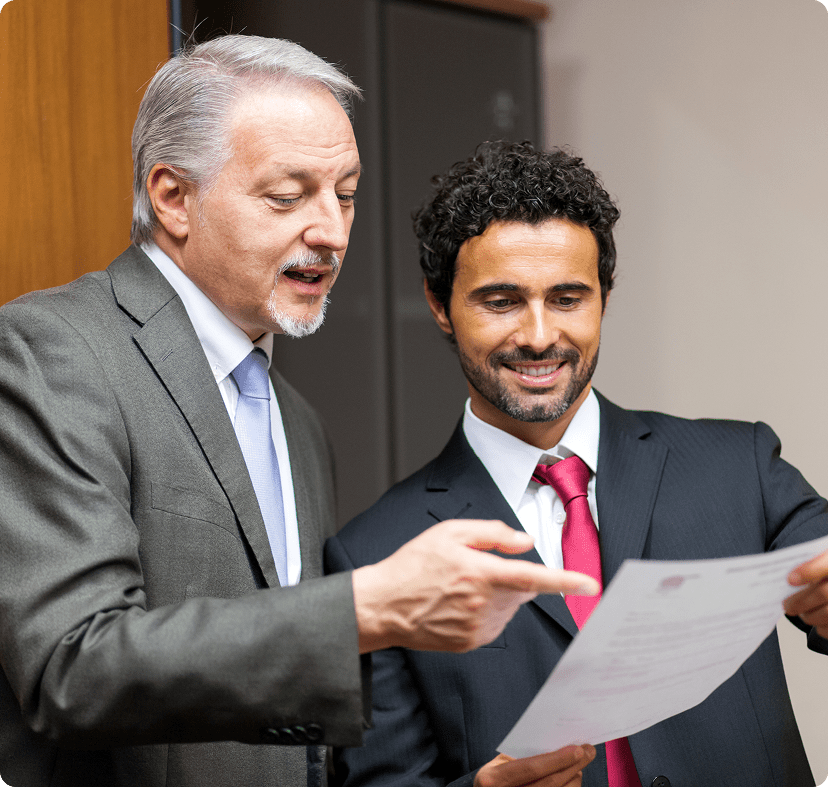

Looking for Growth Capital, Not an Exit?

Access the right investment while keeping control of the business you’ve built.

Not every business owner wants to sell. Sometimes the goal is to grow faster, expand into new markets, or strengthen the balance sheet, without giving up full ownership.

Growth funding is often used for

- Expansion into new markets

- Hiring senior leadership

- Product or service development

- Strategic acquisitions

- Strengthening working capital

Funding That Supports Your Next Phase

Growth funding is not about cash at any cost. The right investment should support your plans, not change them.

We help owners raise capital while remaining firmly involved in the business.

What minority investment can offer

- Retained majority ownership

- Capital for growth initiatives

- Strategic input without interference

- Optional future exit flexibility

- Clear alignment from day one

Raise Capital While Retaining Control

Many business owners choose minority investment rather than a full sale. This allows access to capital without handing over decision-making or direction.

Churchill Mergers acts as a minority stake investment advisor, helping owners find investors who understand their role as partners, not operators.

Choosing the Right Type of Capital Partner

Not all investors bring the same value. Some offer capital only. Others bring experience, networks, or sector insight.

We help business owners decide which type of investor best fits their goals.

Common investor profiles include

Setting Clear Terms from the Start

Growth funding works best when expectations are aligned early. Poor structure leads to tension later.

We help owners shape investment terms that reflect:

This ensures all parties clearly understand their roles and responsibilities, helping to prevent future conflicts by defining the shareholding structure, decision-making rights, performance milestones, future funding considerations, and exit flexibility from the outset.

Protecting Your Position During Negotiations

Raising growth capital is still a transaction. Terms matter, and small details can have long-term impact.

Churchill Mergers supports owners through negotiations to ensure deals remain fair and balanced.

Our role during negotiations includes

Reviewing headline terms

Supporting valuation discussions

Managing investor expectations

Protecting owner interests

Keeping discussions constructive

Thinking Beyond the First Investment

Growth funding should support not just the next step, but the journey ahead.

We help owners think through:

- Future funding needs

- Optional partial or full exits

- Investor succession

- Long-term value creation

This ensures today’s decision still works years from now.

Trusted by thousands of happy customers are using Churchill Mergers.

Professional Services Firm (UK)

Owner-Managed Business

UK & Europe

Professional Firm

Multi-Jurisdiction Business

Latest trends and business news

Digital, AI & Legal/FinTech: Where the Mid-Market is Going

The convergence of digital transformation, artificial intelligence (AI), LegalTech and FinTech is reshaping the mid-market at an unprecedented pace. What was once the domain of

How Regulatory Uncertainty Is Shaping Deal Structures in 2026

In today’s market, regulatory uncertainty is no longer a background risk in mergers and acquisitions. It is a central factor shaping how transactions are negotiated,

Cross-Border M&A: Inward Investment into the UK Post-Brexit

Cross-Border M&A: Inward Investment into the UK Post-Brexit The UK has long been a global hub for cross-border mergers and acquisitions (M&A), attracting significant international

The Impact of Energy Transition & ESG Investing on UK Deal Flow

The evolving landscape of energy transition and Environmental, Social, and Governance (ESG) investing is reshaping the M&A (Mergers & Acquisitions) deal flow in the UK.

Specialty Finance & Marketplace Lending: M&A Trends and Risks in the UK & Europe

Introduction The landscape of specialty finance and marketplace lending in the UK and Europe is undergoing significant transformation. As of October 2025, the sector is

Preparing for Buyer Due Diligence When Selling Your Business

Maximum Valuation: Preparing for Buyer Due Diligence Maximum valuation is every business owner’s goal when selling. One of the most critical stages to achieve this

Benefits of Negotiating the Sale of a Business Through a Broker

Benefits of Negotiating the Sale of a Business Through a Broker Maximum valuation is the ultimate goal when selling a business, but achieving it is

Maximising Earn-Outs on Selling a Business

Selling a Business: Maximising Earn-Outs Selling a business is one of the most significant milestones for any entrepreneur. While upfront consideration is important, many deals

Get in Touch

Speak to our expert today

Schedule a 15-minute introductory call with a senior partner. It is strictly confidential, free of obligation, and the most important 15 minutes you can spend planning your exit.

- Your inquiry is 100% confidential and secured with 256-bit encryption.

Growth Capital Starts with the Right Discussion

If you’re exploring funding options, the best place to start is a calm, confidential conversation.

No pressure. No obligation. Just clarity.